This is CNBC’s Morning Squawk newsletter. Subscribe here to receive future editions in your inbox.

Here are five key things investors need to know to start the trading day:

1. Nvidia’s big day

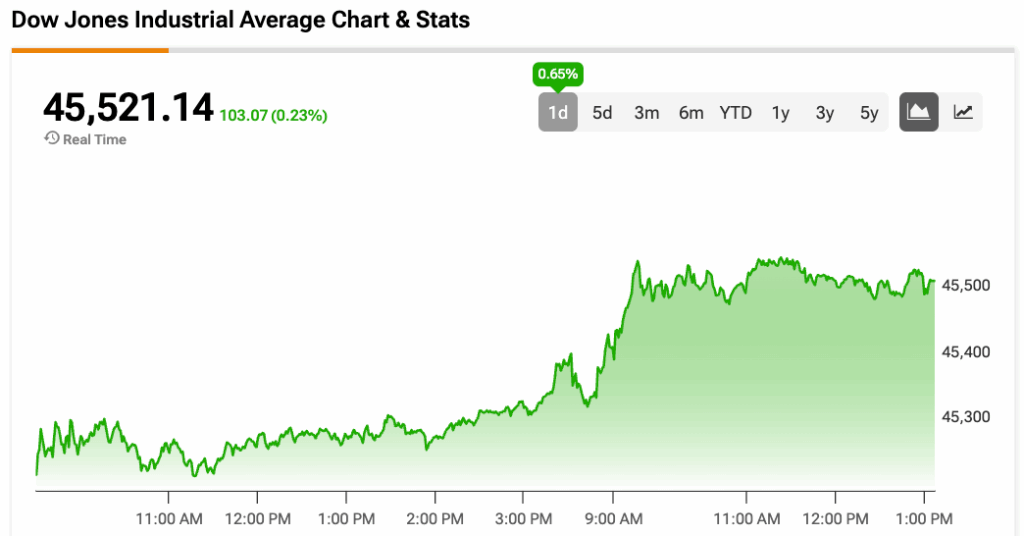

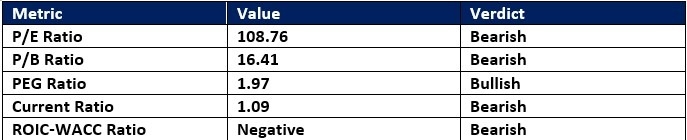

All eyes are on Nvidia ahead of the chipmaker’s second-quarter earnings report due after the bell. The stock — a major market play for the artificial intelligence trend — is closely followed by both Wall Street and Main Street.

As CNBC’s Kif Leswing reported earlier this week, Nvidia is facing high expectations heading into the report. Since generative AI burst onto the scene two years ago, the company’s revenue has more than tripled and its profits have quadrupled. Nvidia became the first company to hit a $4 trillion market cap just last month.

CNBC will cover the results live on air and online as soon as they’re released this afternoon. Shares of Nvidia were higher before the bell. Follow live markets updates here.

2. Cook fights back

U.S. President Donald Trump and Lisa Cook, governor of the U.S. Federal Reserve

Annabelle Gordon | Reuters | Al Drago | Bloomberg | Getty Images

Federal Reserve Board Governor Lisa Cook is not backing down after President Donald Trump said he was removing her from her post at the central bank. Her lawyer said yesterday that Cook plans to challenge Trump’s move in court. That lawsuit could be filed as soon as today, sources told CNBC’s Steve Liesman.

Here’s the latest:

- In its first statement since Trump announced the firing on Monday, the Fed said it would abide by any court decision, while noting that Trump needs cause to fire Cook.

- Trump, who for months has pushed for lower interest rates, said he will soon have a “majority” of his own nominees on the Fed committee that sets rates.

- There are similarities between the standoff playing out between the White House and the Fed, and President Richard Nixon’s pressuring of the central bank in the 1970s, according to Nomura. The bank looked back half a century for insight into how markets might react.

- For more on the Fed, Cook and what a legal showdown with Trump could mean for investors, read CNBC’s Q&A.

3. The White House’s wish list

U.S. Secretary of Commerce Howard Lutnick participates in a South Korea-U.S. business roundtable with South Korean President Lee Jae Myung (not pictured) at The Willard Hotel in Washington, D.C., U.S., August 25, 2025.

Annabelle Gordon | Reuters

The U.S. government’s stock portfolio may be getting some defense exposure.

Commerce Secretary Howard Lutnick told CNBC yesterday that Trump’s Pentagon is weighing whether to open stakes in defense contractors. Lutnick noted the high share of revenue coming from federal contracts such as Lockheed Martin, saying the company is “basically an arm of the U.S. government.”

As CNBC’s Kevin Breuninger notes, the commerce chief’s comments come just days after the U.S. government took a 10% stake in Intel.

4. Shopping, not dropping

A Kohl’s store in Sun Valley, California, on July 22, 2025.

Alisha Jucevic | Bloomberg | Getty Images

Despite grappling with sliding sales and an ongoing search for a permanent CEO, Kohl’s is enjoying a change of pace this morning.

The retailer reported earnings that surpassed Wall Street’s expectations on both the top and bottom lines for the second quarter. Earnings per share came in particularly strong: Kohl’s posted an adjusted 56 cents against a consensus forecast of 29 cents.

Shares of the retailer surged more than 20% in premarket trading following the results. That could signal a change in course for the stock, which has dropped more than 33% over the last 12 months.

Get Morning Squawk directly in your inbox

5. No paper rings

Tight end Travis Kelce, #87 of the Kansas City Chiefs, celebrates with Taylor Swift after the AFC championship football game against the Buffalo Bills, at GEHA Field at Arrowhead Stadium in Kansas City, Missouri, on Jan. 26, 2025.

Brooke Sutton | Getty Images Sport | Getty Images

Baby, Taylor Swift said yes.

The singer announced her engagement to NFL tight end Travis Kelce yesterday and, believe it or not, there’s an investing angle. The couple’s news — and photos of Swift’s “cushion cut” engagement ring— appeared to cause a spike in shares of Signet Jewelers, one of the only jewelers that trades on a major exchange.

— CNBC’s Dan Mangan, Melissa Repko, Kevin Breuninger and Kif Leswing contributed to this report.