These stocks are up for the year, and the upward momentum is unlikely to stop.

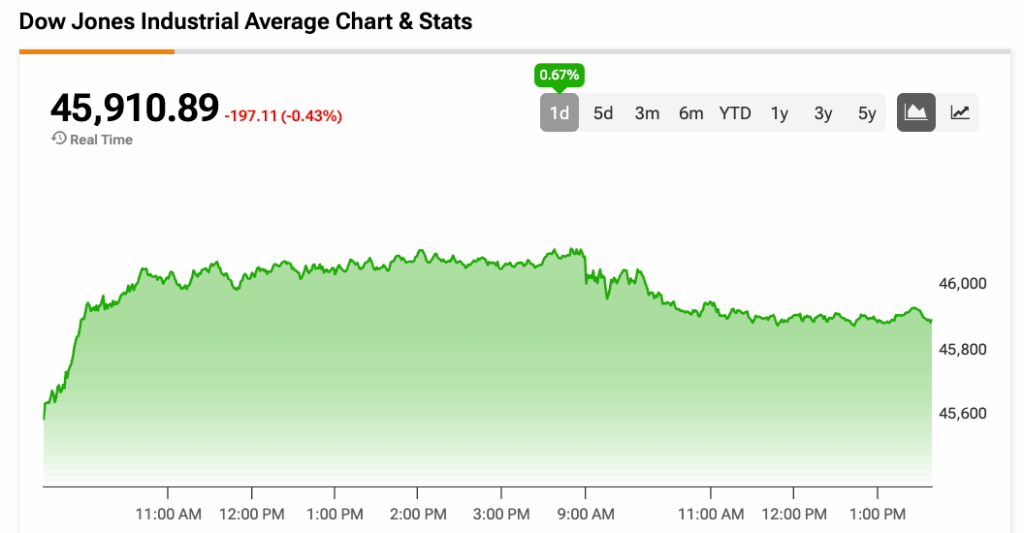

The indexes are at all-time highs, which is good news for shareholders. Since record highs tend to inspire more buying, the bull market could continue.

One drawback of bull markets is that they tend to leave bargain-hunting investors with few options. Fortunately, value-oriented investors can still find reasonably priced stocks in today’s market. With that in mind, investors may want to consider these three growth stocks before they join the market’s high flyers.

Image source: Getty Images.

1. AMD

Advanced Micro Devices (AMD 1.91%) may not look like an excellent option at first glance. It remains behind market leader Nvidia in the artificial intelligence (AI) accelerator market. Also, its P/E ratio of 87 makes it appear expensive. However, the valuation looks more attractive considering its 39 forward P/E ratio. Also, the draw is not limited to valuation.

AMD is comprised of four distinct business segments, which often operate on varying business cycles. Recently, its struggling gaming and embedded segments have shown dramatic improvements. Gaming was AMD’s fastest-growing segment in the second quarter of 2025, and the decline in embedded revenue is now down to 3%. Overall, revenue growth in Q2 was 32%, helping to foster the aforementioned lower forward earnings multiple.

Additionally, on the AI accelerator front, the upcoming MI400 release has left investors wondering whether it can catch up to Nvidia competitively. That could be huge, given the industry’s estimated compound annual growth rate (CAGR) of 29% through 2030.

Overall, AMD’s stock is up over 25% year to date. Assuming the improvements continue, it is likely the stock price will rise with its financial metrics over time.

2. Sea Limited

As a Singapore-based tech conglomerate that operates mostly in Southeast Asia, Sea Limited (SE -0.14%) is likely not on the radar of most American investors.

However, the company appears on track to become the MercadoLibre of Southeast Asia. Thanks to its Shopee segment, it is the leading e-commerce company in its region. It has also followed MercadoLibre by investing heavily in a logistics network to build a competitive advantage.

Like MercadoLibre, it also provides fintech services in its region, bolstering both Shopee and an overall fintech business. Additionally, it differs from MercadoLibre in that it began as gaming company Garena. The public is likely familiar with Garena primarily through Free Fire, which was the world’s most downloaded mobile game in 2024 as measured by daily active users.

The company struggled after the pandemic after attempting e-commerce outside of its region and from the declining in gaming after the pandemic ended. However, it pulled back most of the failing e-commerce operations and has revived growth in gaming.

Consequently, all three segments are now in growth mode. Revenue rose 38% in Q2, and the stock is up 80% since the beginning of the year. At 49 times forward earnings, it’s likely not too late to buy at Sea Limited as it continues to build momentum.

3. Uber

Another company in an uptrend is rideshare giant Uber Technologies (UBER 1.27%). Although it lags DoorDash in the U.S. delivery market, it is the leader in that segment globally. Additionally, its mobility segment continues to prosper, driving the company’s rapid growth.

Moreover, Uber may benefit from a mobility trend that takes it to the next level. Autonomous driving companies such as Alphabet‘s Waymo and General Motors‘ Cruise are turning to Uber’s platform to bring customers to their self-driving cars. Assuming this succeeds, it could drive outsized growth for both Uber and its stock.

Furthermore, Uber has driven significant growth, even without that emerging business. In the second quarter of 2025, revenue of $12.7 billion surged 18% higher compared to year-ago levels. That increase occurred as monthly active platform consumers rose to 180 million from 156 million one year ago. Amid that improvement, the stock has risen by more than 55% since the beginning of the year.

Additionally, the stock trades at just 16 times earnings, though a one-time charge skewed that figure. The forward P/E ratio of 26, which excludes one-time charges, indicates this is a reasonably priced stock. As Uber stock’s mobility and delivery revenues continue trending higher, it is likely to become pricier, creating an incentive for investors to buy the stock sooner rather than later.

Will Healy has positions in Advanced Micro Devices, MercadoLibre, Sea Limited, and Uber Technologies. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, DoorDash, MercadoLibre, Nvidia, Sea Limited, and Uber Technologies. The Motley Fool recommends General Motors. The Motley Fool has a disclosure policy.