After gaining over 800% in five years, investors have high hopes for Broadcom when it reports earnings on Thursday.

Nvidia‘s (NVDA -0.24%) latest quarterly earnings were a textbook example of the importance of expectations.

Despite delivering blowout results and guidance, Nvidia stock sold off simply because investors were already ultra-optimistic heading into the print. Even after the pullback, Nvidia is still on track to crush the S&P 500 (^GSPC 0.51%) for the third consecutive year.

The stakes are arguably just as high for fellow chip giant, Broadcom (AVGO 1.30%). Broadcom has become such a massive company that it has surpassed Tesla in market cap — paving the way for a new group of market-leading growth stocks known as the “Ten Titans.”

Here’s what investors should look for when Broadcom reports earnings on Sept. 4 after market close, and why its results and management’s commentary on the call could have ripple effects across the artificial intelligence (AI) investing landscape.

Image source: Getty Images.

1. Broadcom is guiding for record AI revenue

Broadcom reports its results under two segments, semiconductor solutions and infrastructure software.

The company completed its acquisition of VMware in November 2023, which catapulted the software segment from $7.6 billion in fiscal 2023 revenue to $21.5 billion in fiscal 2024, while semiconductor solutions grew from $28.2 billion to $30.1 billion.

The VMware acquisition transformed Broadcom into a fully integrated infrastructure software company, building on its core businesses in networking, broadband, wireless, storage, industrial, and automotive.

In addition to these two large segments, Broadcom also reports AI revenue, which isn’t its own segment, but rather highlights the portions of semiconductor and software that are linked to AI. Broadcom is driving AI growth with its custom AI accelerators (XPUs), a type of advanced application-specific integrated circuit (ASIC) primarily designed for hyperscalers.

In its second quarter fiscal 2025 for the period ended May 4, 2025, Broadcom reported AI revenue of $4.4 billion, up 46% year over year, and guided for $5.1 billion in Q3 AI revenue. Overall revenue was up 20% against Q2 fiscal 2024, which was a difficult comp, proving Broadcom is showing no signs of slowing down.

Last quarter, AI accounted for 29% of total revenue, illustrating how the core business is growing at a relatively modest pace outside of AI. Broadcom is guiding for Q3 revenue of $15.8 billion, meaning AI is projected to make up nearly a third of total revenue in the quarter Broadcom will report on Thursday.

Investors will be laser-focused on that quarterly AI figure, as well as Broadcom’s outlook for the full fiscal year. Continued AI momentum will validate Broadcom as an AI powerhouse and help justify its expensive valuation.

2. Hyperscaler appetite for ASICs versus GPUs

Broadcom has been expanding its serviceable addressable market for its AI chips, designed to handle AI workloads, which could reach a staggering $90 billion by fiscal 2027. Broadcom expects its hyperscale customers to double accelerator cluster sizes from 500,000 to 1 million to improve performance and lower costs. An accelerator cluster is basically a group of servers equipped with custom AI chips. As data centers grow in size and sophistication, they will require more chips to handle increasingly complex AI workloads.

Arguably, the most exciting element of Broadcom’s investment thesis is the potential for hyperscalers to outfit data centers with more and more custom-made chips designed by Broadcom rather than graphics processing units (GPUs). GPUs, like those made by Nvidia, are like all-purpose workhorses that are really good at handling complex AI workloads. By comparison, ASICs, as the name “application-specific” entails, are meant to handle a specific function really well, often at lower cost.

ASICs won’t replace GPUs across all data center applications, but there is a possibility that Broadcom’s custom AI chips, along with associated networking gear, like Broadcom’s Tomahawk and Jericho switches, and compute, memory, and packaging capabilities, will become a preferred solution among hyperscalers. Management’s commentary on Broadcom’s AI chip business is worth following on the upcoming earnings call, especially within the context of Nvidia’s booming AI business.

3. Broadcom’s market-moving potential

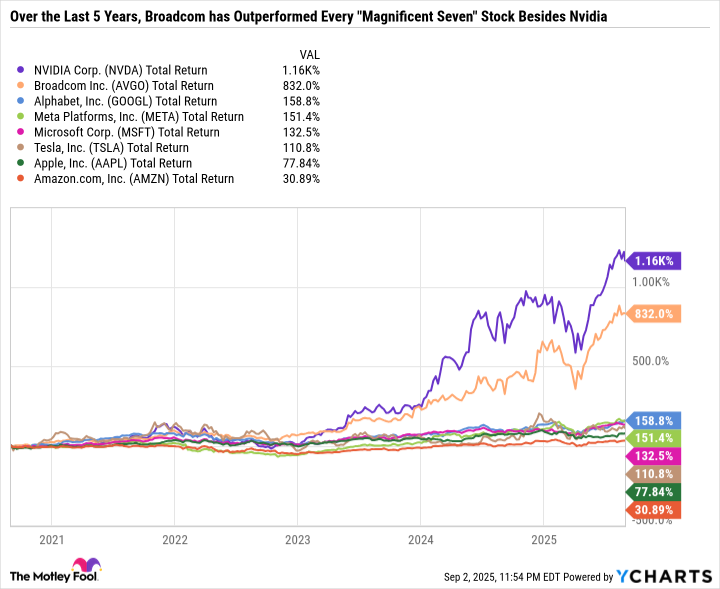

Sept. 4 is a significant day for Nvidia and Broadcom investors, as well as the market in general. The “Magnificent Seven” gets a lot of attention for its outsized returns in recent years, but Broadcom has significantly outperformed the group (outside of Nvidia) over the last five years.

NVDA Total Return Level data by YCharts

With a more than 800% total return during that period, Broadcom has pole-vaulted its market cap from under $150 billion to $1.4 trillion, and Nvidia has gone from $341 billion to $4.1 trillion. Combined, Nvidia and Broadcom have created around $5 trillion in market cap in five years — which is like creating a company the size of Amazon plus Alphabet out of thin air.

Nvidia and Broadcom’s results aren’t just big news for the semiconductor industry, tech investors, and the AI narrative — but also the whole stock market.

If Broadcom sustains its AI momentum, it could make the S&P 500 even more concentrated in the largest growth stocks. But this concentration has been a net positive for investors, as the S&P 500 has delivered higher than historical gains in recent years, largely thanks to just a handful of companies. However, the concentration also makes the market prone to heightened volatility if a few influential companies sell off.

Daniel Foelber has positions in Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.