These market-beating stocks delivered returns between 640% and 12,452% over the last decade. They’re just getting started on their next big growth chapters.

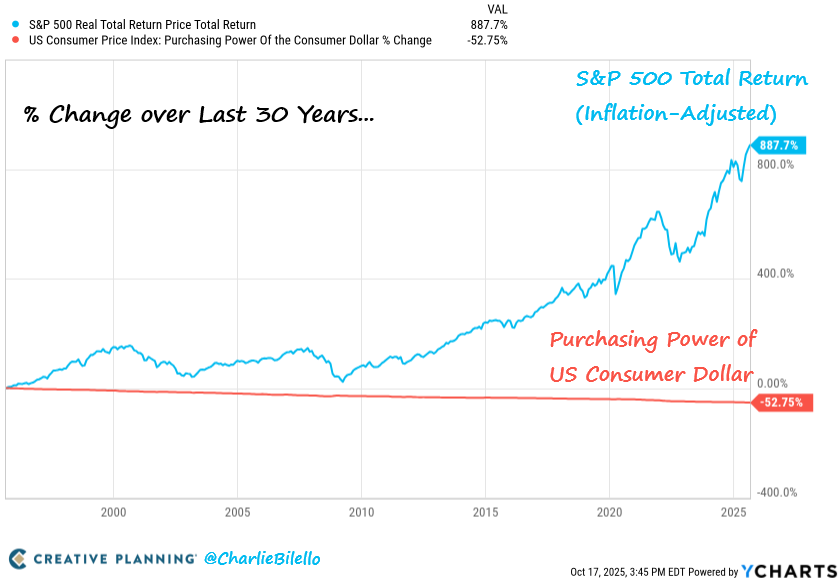

There are many ways to build wealth in the stock market, but growth stocks hold a special place in my heart. Patiently holding on to high-growth stocks for the long run is a winning strategy. Of course, the real trick is to find those long-term winners. But you don’t have to gamble on unproven upstarts — established industry giants with many years of market-crushing returns can keep running higher.

So let’s check out three stocks that saw monster returns over the last decade and still have room to run. They are still great buys for the long term.

Netflix 10-year returns: 1,019%

Media-streaming veteran Netflix (NFLX 1.33%) is my first suggestion.

My portfolio wouldn’t be the same without this innovator. After dominating the video rental market, Netflix jumped into the digital streaming opportunity before anybody else saw it as a business idea. The shares I bought in the Qwikster debacle of 2010 are up by 10,005% today, almost exactly 14 years later.

And it’s an honest-to-goodness business success. Netflix nearly doubled its net income from 2022 to 2024 while revenue rose by 23%. Other media stocks are just trying to catch up to Netflix, which is the only entertainment stock among the 60 largest stocks by market capitalization.

The growth story isn’t ending here, either. Netflix has a lot of growth left to do on a global level. Recent experiments include video games, brick-and-mortar stores, and a Netflix-themed entertainment center in Philadelphia. If you don’t own any Netflix stock yet, you should at least consider it.

AMD 10-year returns: 12,452%

You know how Nvidia (NVDA 0.86%) absolutely dominates the market for artificial intelligence (AI) accelerator chips? Well, Advanced Micro Devices (AMD -0.52%) wants some of that action. In fact, the eternal underdog has become a serious challenger to Intel (INTC 0.47%) and Nvidia is next on AMD’s target list.

Once upon a time, not that long ago, AMD’s chip sales were essentially a rounding error next to Intel’s shipments. It didn’t matter if you looked at big-iron server processors, popular desktop chips, or low-power laptop CPUs; Intel was the king and AMD was hardly worth mentioning.

But in the second quarter of 2025, AMD held approximately 40% market shares in both the data center and in desktop systems, measured by revenues. That’s a big deal.

Image source: Getty Images.

And then there’s the AI opportunity. AMD’s Instinct line of AI accelerators has been overshadowed by Nvidia’s higher-performing solutions ever since OpenAI’s ChatGPT came along. That’s changing, too. OpenAI just committed to a massive amount of AMD business over the next five years, diversifying its data centers away from the Nvidia-heavy design it’s using today.

Now, OpenAI will still order even more Nvidia chips over the same period, but this deal gives AMD a big foot in the door. If OpenAI is investing in AMD Instinct accelerators, others will probably start kicking those tires, too.

Alphabet 10-year returns: 640%

Finally, I’ve been a big fan of Alphabet (GOOG 0.86%) (GOOGL 0.82%) since Google rewrote the rule book for online search engines.

The company also disrupted digital advertising before ramping up the Android empire of mobile devices. I was a skeptic of the YouTube buyout at first, but that turned out to be a game-changing (and market-creating) investment. More recently, the Google Cloud platform is a serious challenger for the global cloud computing throne, and Gemini can keep up with OpenAI’s best ChatGPT tools in many ways.

And I have no idea what else Alphabet might be up to in the next decade. It’s probably too early to expect significant business results from its quantum computing research, but you never know. Will Waymo become the self-driving ride-sharing service of choice in more than a few test markets? Again, I don’t know — but it’s a real possibility.

I don’t know, but I’m convinced that the trillion-dollar tech giant will keep growing for decades to come. Market shifts and new challenges tend to inspire fresh innovation and brand-new business ideas in Alphabet. That’s a great recipe for long-term success.

Anders Bylund has positions in Alphabet, Intel, Netflix, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Intel, Netflix, and Nvidia. The Motley Fool recommends the following options: short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.