Want to set your growth-stock portfolio on autopilot? These three stocks could be worth holding for decades.

Some investors trade often. Others take their time before pouncing on any particular stock, focusing on long-term investments they can just forget about for decades.

Imagine you’re setting up a brand new portfolio for the long haul. Sure, you could stick with a tried and true S&P 500 index fund and call it a day, but you want to beat the market with this mini-portfolio. And it needs to be a low-effort activity, where you can forget about checking up on its stocks for decades — and never lose a minute of sleep over their performance.

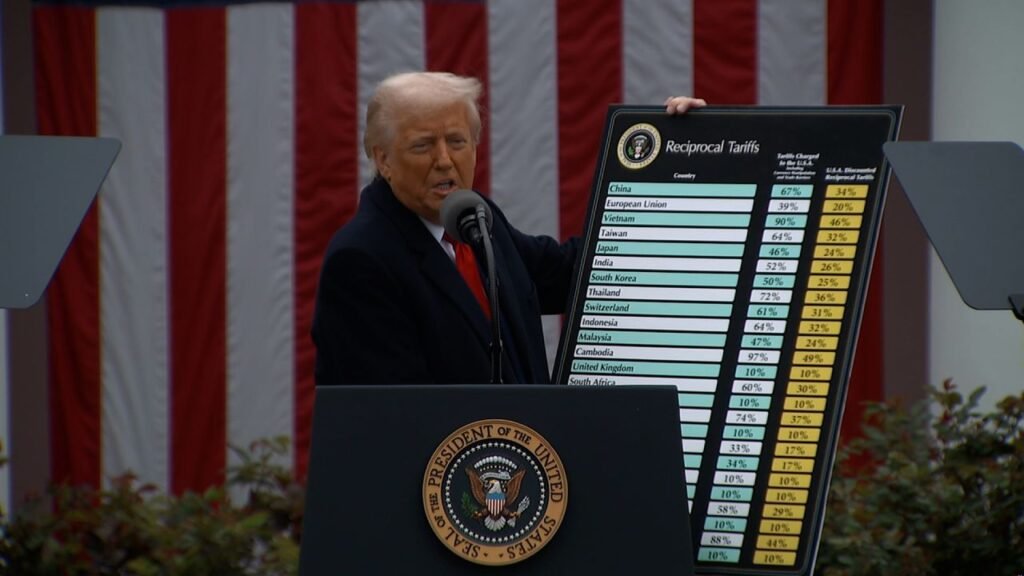

Image source: Getty Images.

In this case, you should have a couple of clear objectives in mind:

- Many years of longevity and business growth. A true long-term investment should still be relevant and thriving in a decade or three.

- A competitive edge. Why settle for a decent performer in a strong industry when you can insist on top-shelf excellence?

- A diverse group of stocks. The markets will ebb and flow over time, so your long-term investment bets should have distinctly different target markets. A focused artificial intelligence (AI) portfolio is one thing, and a broad basket of long-haul growth stocks is another.

So here are three growth stocks that meet all of these criteria. They are built to last, set up for long-lasting business growth, and leaders in their chosen fields. Together, their wide range of innovative operations should provide you with strong average returns across a wide range of stock market conditions.

Just buy them and jump in the lazy river, watch your kids grow up, or learn guitar over the next couple of decades. You won’t have to worry about your growth stocks.

AutoZone’s in the fast lane

Car parts retailer AutoZone (AZO 1.98%) is a surprising performer. The stock has gained 238% over the last 5 years and 16% in the first half of 2025. These are market-beating returns, comparable to fellow sector giant O’Reilly Automotive (ORLY 2.25%).

I wouldn’t hate it if you picked O’Reilly instead of AutoZone, but this company has a couple of important advantages over the competition. First, the stock trades at significantly lower valuation multiples across the board. AutoZone also sports 12% higher annual revenues than O’Reilly, not to mention 8% richer bottom-line earnings. It even has an edge in long-term sales growth rates and a stronger balance sheet.

The company isn’t sitting on its work-gloved hands, either. AutoZone is making heavy investments in a more capable supply chain, while also opening 84 net new stores in the recently reported Q3 of 2025.

And this happens to be a great time to stock up on shares in the retail sector. Many investors worry about tariffs and international conflicts, both of which can make consumers less likely to spend money. But I’m sure Americans will continue to fix and maintain their cars, regardless of the political climate. AutoZone should remain a leading name in that game for years and years, producing robust stock returns in the process.

Roku is my favorite media-streaming underdog

I keep coming back to Roku (ROKU 2.16%) when I’m looking for long-term growth stories. The media-streaming expert also happens to be undervalued most of the time, making it an easy pick in a crowded market.

Sure, I could have recommended Roku’s former parent company Netflix (NFLX 0.92%) instead. Both companies are exploring a global media market with top-notch innovation under their belts and promising growth trends. But Roku is at an earlier stage of its international growth story, with so much untapped market value left to grab. Netflix is far from stalled out — but Roku is just getting started. This is the more exciting growth story today.

The company is currently unprofitable, but that’s by design. Roku’s management is throwing everything but the kitchen sink at the company’s growth opportunities, investing in everything from original content to powerful advertising platforms. The stock has been disappointing in recent years, but I see the downtrend as a wide-open buying window. If Roku isn’t beating the market by 2035, I’ll buy a hat just to eat it. Hold the salt, please.

IBM proves that old dogs really can learn new AI tricks

Finally, let’s tap into the unstoppable generative AI boom. IBM (IBM 1.39%) may not strike you as a leader in that jam-packed industry, but that’s a mistake. Big Blue is simply going after a different customer population than its headline-writing AI peers. As always, IBM is all about business-class services for enterprise customers. It’s a massive target market, IBM’s long-term AI focus is starting to pay off right now, and the stock looks dirt cheap anyhow.

IBM shares are changing hands at the affordable price of 4.3 times sales or 21.5 times free cash flows. If IBM were a part of the “Magnificent Seven” group, it would be the lowest-priced option in terms of cash flow-based valuations.

Plus, this company wrote the book on business longevity. IBM was founded more than a century ago, thriving despite a couple of world wars and a variety of economic crises. Big Blue should be the first place to look when you’re on the hunt for long-term investment ideas.

Anders Bylund has positions in International Business Machines, Netflix, and Roku. The Motley Fool has positions in and recommends International Business Machines, Netflix, and Roku. The Motley Fool has a disclosure policy.