Earnings are strong. The US economy is holding steady. Fed rate cuts are coming. Nothing looks like it could go wrong in the stock market now.

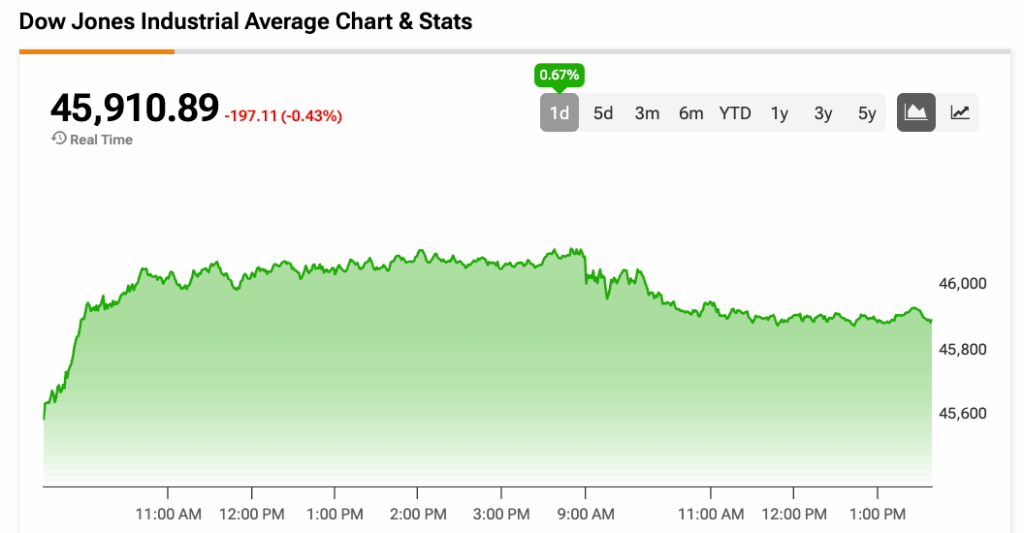

That, at least, is what investors seem to think, with major indexes breaking fresh records this week as traders took in tame inflation data and grew more confident in coming Fed easing.

But Goldman Sachs has some reservations about what looks to be an ideal environment for stocks. In a note to clients on Thursday, strategists highlighted two risks facing the market that could eventually pressure stock prices lower.

Stocks have largely rallied because the US economy looks to be in a sweet spot: Growth remains resilient, but there are pockets of the US—like the job market—flashing signs of weakness, which signals the Fed has room to cut interest rates.

Meanwhile, August inflation rose in line with economists’ expectations, keeping rate-cut hopes elevated.

“With the overall contours of our macro forecasts broadly reflected in market pricing, there are risks on two fronts,” Goldman said.

1. Markets start to worry about a recession

Goldman Sachs Global Investment Research

Bad news is good news for the stock market lately, with weak job growth and a slowing activity in areas like manufacturing bolstering the case for rate cuts — but that paradigm could flip with little notice.

A potential recession has been market’s mind for some time, but investors have mostly shrugged off the risks: The estimated market-implied US forward growth rate currently hovers around 1.6%, according to Goldman’s analysis, indicating that most investors still expect the economy to grow at a pace near the historical norm.

Related stories

Business Insider tells the innovative stories you want to know

Business Insider tells the innovative stories you want to know

Those views could be upended, though, should the job market continue to weaken, strategists said. While the unemployment rate remains near a historic low, hiring has been softer than expected in recent months, and the US added 911,000 fewer jobs than initially thought from April 2024 through March of this year, according to a preliminary revision from the Labor Department.

“The quickest way for the market to worry that it has misjudged the limited nature of near-term economic weakness is a sharper rise in the unemployment rate. That scenario would lead the market to pull forward cuts and put equities under pressure,” they added.

2. Views on Fed rate cuts could shift

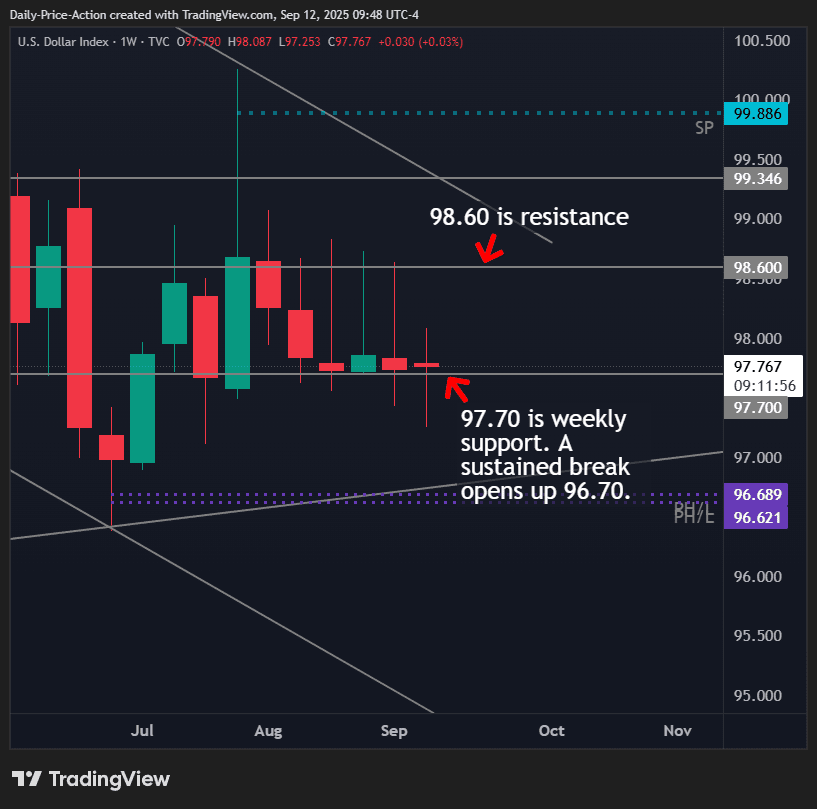

On the flip side, if growth in the US remains strong, investors may start to worry that they’ve priced in Fed rate cuts too aggressively. That could also put pressure on stocks, given how optimistic the market has been about Fed easing in recent weeks.

Investors are now pricing in a 92% chance the Fed is set to trim its target rate at least 25 basis points at next week’s policy meeting, according to the CME FedWatch tool. Investors are also pricing in a 79.4% probability that the Fed will cut rates three times or more from their current levels by the end of the year.

“Because growth worry recently has been much more limited, good growth news and the avoidance of recession from here is less likely to prompt growth upgrades and more likely to lead to a reversal of the dovish policy shock that the market has priced than last year. In that case, we could see upward pressure on rates in a way that is less supportive of equities,” the bank said.

Goldman said it believed the path for risk assets remained “friendly” going forward, despite the near-term risks.

In a previous note, strategists at the firm said they believed the US had entered a new secular bull market, giving investors opportunities in areas like technology, services, and manufacturing, as well as diversification opportunities outside of the US.