These two dividend stocks won’t pop off the page, but the best is likely yet to come.

“Dividends are like rewards for patience and loyalty, a tangible expression of a company’s gratitude to its shareholders.” — Peter Lynch

Dividend stocks offer investors plenty of benefits and historically have outperformed non-dividend-paying stocks. One of the key things for investors is to try and find not only a solid dividend, but one that has room to grow consistently.

The two companies featured here offer exactly this.

1. American Tower: Soaring mobile data needs

It seems as if we’re all addicted to our phones, and if that’s the case, it’s pretty good news for American Tower (AMT -0.53%). American Tower owns and operates roughly 150,000 wireless towers throughout the U.S., Asia, Latin America, Europe, and Africa. It operates in 25 countries across nearly all continents. The company has been focused on combining its tower knowledge and experience to capitalize on increasing global demand for mobile data capacity.

Here’s the good news: the tower business is a good one to be in. Its towers boast a concentrated customer base, with most of the revenue generated by the top few mobile carriers. Contracts and annual escalators provide transparent growth, and since towers have significant operating leverage, revenue growth should also push margins higher in the medium term.

Further, the world is continuing to build out 5G infrastructure, which should help drive growth for American Tower in the near term. Management has also made a push into international markets where opportunities for growth are not only higher, but still preparing for the next 5G growth stage — for example, Africa is still progressing through 4G technology. American Tower is also diversifying its business a little bit with the 2021 acquisition of CoreSite, a data center business.

While the U.S. and Europe will remain a focus, investors shouldn’t worry about slowing growth in a more developed market. A maturing U.S. market will need little capital investment to support continued revenue and margin growth.

American Tower operates as a real estate investment trust, or REIT, which essentially owns and operates income-producing towers and allows investors to buy shares in its portfolio of properties. A tricky thing with REITs is that to avoid corporate income taxes, the company must distribute at least 90% of taxable income to shareholders as dividends — which leaves investors with a healthy 3.5% dividend yield currently and room for growth.

2. FedEx: Special delivery on a global scale

FedEx (FDX 0.45%), the pioneer of overnight delivery in the early 1970s, remains the world’s largest express package provider. FedEx is one of three juggernaut carriers that dominate the global for-hire parcel delivery landscape, with FedEx and UPS the major U.S. players and DHL Express leading Europe.

While labor constraints and wage inflation weighed on margins over the past few years, the company’s Drive program was able to gain traction throughout fiscal 2024 and 2025, helping to support margins. The Drive program was essentially a strategic program to reduce costs and increase long-term profitability through operation optimization and leveraging data and technology. The program was expected to drive around $4 billion in annualized structural cost reductions.

FedEx has competitive advantages, including cost advantage and efficient scale, and there are significant barriers in global parcel shipping that keep would-be competitors thinking twice. While Amazon has successfully built a network for its own package delivery needs, it’s unlikely the company will offer its capabilities as a service to the broader marketplace.

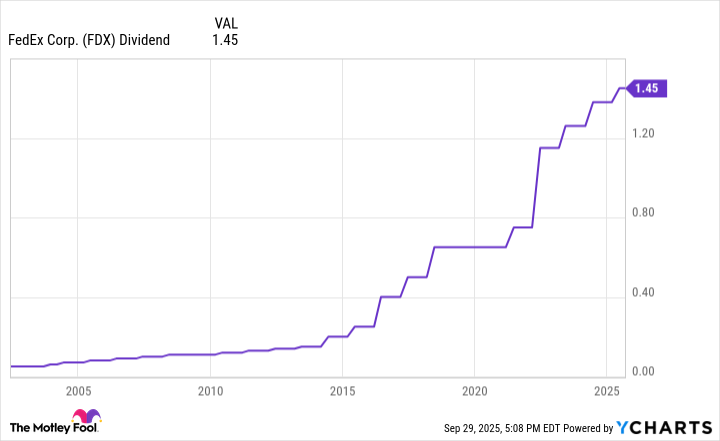

The good news for investors, especially income investors, is that FedEx has invested in dividend growth over the past decade, as you can see in the graph below.

Data by YCharts.

Currently, FedEx’s dividend yield sits at a healthy if unspectacular 2.4%, but investors could be in store for more growth as the company has transitioned from growth initiatives to improving efficiency, including the consolidation of its express and ground operations. These fundamental changes should help the company cut costs, as with its Drive program, and further support margin growth that should eventually trickle down to an increasing dividend.

Are they buys now?

Both of these companies are seemingly fairly valued, so the story for investors here is about upcoming dividend growth. American Tower is well-positioned to grow margins in developed countries while expanding for growth in developing countries, supported by the build out of 5G infrastructure. All of those factors should drive the company’s income and dividend going forward.

For FedEx, the company is trying to turn into a leaner and meaner parcel delivery machine, and if it can continue gaining traction with its cost-cutting programs and drive efficiency, improving cash flow and bottom line should enable the company to continue dishing out more dividends going forward.

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends American Tower and United Parcel Service. The Motley Fool recommends FedEx and recommends the following options: long January 2026 $180 calls on American Tower and short January 2026 $185 calls on American Tower. The Motley Fool has a disclosure policy.