Smart investors know that you don’t need to swing at every pitch. Sometimes, simply parking a modest sum in the right play before the crowd arrives can reap outsize rewards. A fast-maturing corner of crypto — real-world asset (RWA) tokenization — offers that setup today as it moves stocks, bonds, and other traditional instruments onto blockchains for cheaper, faster settlement compared to existing financial technologies.

Two coins already capturing some of the capital flows related to tokenization are Solana (SOL -0.58%) and XRP (XRP 1.14%). They approach the megatrend of asset tokenization slightly differently, giving investors a paired bet on whatever flavors of tokenized finance proliferate next. Even a relatively modest investment of $1,500 could be intelligently allocated into either of these two coins, so let’s investigate both. And I suggest holding for at least three years.

This chain is a speed specialist

Solana’s chief selling points are its throughput and its cheapness.

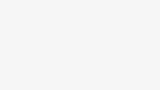

The network routinely clears more than 1,000 transactions per second (TPS) at sub-penny fees, letting developers iterate without worrying that usage spikes will crush users’ wallets. That has proved invaluable for tokenized stocks. After a platform called xStocks launched on the chain in late May, the value of stock tokens on Solana tripled to about $48 million within three weeks; as of late July, the chain’s tokenized stocks are worth more than $102 million.

Zoom out, and the corpus of tokenized assets on Solana now stands near $553 million, up by more than 218% this year alone, which is more than double the sector’s overall growth.

Image source: Getty Images.

The chain is thus emerging as a natural magnet for asset issuers experimenting with tech that’s beyond their traditional venues.

If Boston Consulting Group’s projection that the sum of tokenized real-world assets will reach $16 trillion by 2030 is even half-right, a rising tide of assets would keep nudging validators to lock up Solana for staking, tightening supply. Furthermore, asset issuers will need to buy and hold the coin to manage their tokens, not to mention parking at least some of their fiat currency on the chain as stablecoins.

Regulatory surprises remain the main risk here, as tokenized stocks and funds live in (partially) uncharted territory. But, that risk seems likely going to get resolved within the next few years thanks to new leadership at the Securities and Exchange Commission (SEC), and when it does, the chain would pick up a new tailwind in the form of regulatory clarity.

Buying $1,500 worth of Solana and holding it through then is thus a favorable course of action.

This institutional plumber is carving a compliance moat

Where Solana thrives on raw speed, the XRP Ledger (XRPL) is a money transfer and asset-tracking system that embeds the (boring but essential) features banks actually ask for, like account freezing tools, native blacklisting, and built-in identity layers that satisfy know-your-customer (KYC) rules without the need to bolt on third-party widgets. Those controls are attracting issuers of regulated debt and payment instruments, which are the (once again, boring but essential) enormous backbone of finance.

XRP now has roughly $133 million in tokenized assets on its chain, up from under $50 million a year ago. That footprint is small compared to other chains like Ethereum, but its composition skews toward institutional debt rather than stocks. Every new bond or payment token minted consumes XRP for fees, subtly trimming float and sharpening its scarcity narrative.

Whereas one of Solana’s strong points so far has been with tokenized stocks, XRP’s advantage at the moment is in its deeply liquid tokenized U.S. Treasury bill platform, worth $75.2 million, which is something that banks and other financial institutions need. When those players use XRP as part of their financial back end, they gain a significant advantage from being able to tap into borrowing those Treasuries natively on-chain. Furthermore, the ledger’s tight compliance posture also reduces headline risk, as institutions can adopt the coin without cobbling together legal patchwork like they’d need to do with Ethereum-based solutions.

Of course, the chain relies entirely on the business development muscle of Ripple, the business which issues XRP. Should legal or strategic missteps slow institutional partner onboarding, the coin’s growth would stall. Still, the chain’s design speaks the language of regulators, which is a competitive advantage that compounds as rules tighten worldwide and as larger players (with heftier compliance requirements) enter the crypto space.

Over the coming years, as institutions pile into crypto to take advantage of its technology, few chains are better positioned than XRP. And that’s why it’s worth buying with $1,500 today, and holding for at least three years.