Investors looking for reliable option income ETFs should avoid the lure of huge yields and stick with something a bit more boring.

Income-focused investors have plenty of options at their disposal when it comes to exchange-traded funds (ETFs). One type of ETF that is gaining a lot of traction today is option income ETFs. The big draw is large yields, but there are material risks to consider before you buy one of these funds.

In the end, most investors will be better off with fairly simple options like Amplify CWP Enhanced Dividend Income ETF (DIVO 0.18%) and Amplify CWP International Enhanced Dividend Income ETF (IDVO 0.24%). The ultra-high yields on offer from ETFs like YieldMax NVDA Option Income Strategy ETF (NVDY 1.39%) could be a siren’s song that hurts you more than helps you.

Image source: Getty Images.

What is an option?

Options are created when a person sells another person the right, but not the obligation, to buy or sell a stock at a future date. The person buying the right pays a fee to the person selling the right. The most common type of option is a covered call, in which a person who owns a stock sells someone the right to buy that stock at a future date. If the option is used (exercised), the stock must be sold. If the option is not exercised, nothing happens. Either way, the fee that is paid is kept by the stockholder.

Selling covered calls is a fair amount of work and only more active, and probably aggressive, investors should use this income-generating approach. However, it is a way to create an additional income stream from your stock portfolio that could be valuable. This is where option income exchange-traded funds come in. Simply put, you don’t have to do the work because someone else is doing it for you.

Tread carefully with option income ETFs. There are some that offer dividend yields that just can’t be sustained over the long term. And often, those same ETFs are so highly concentrated that there is material asset-specific risk (also called idiosyncratic risk) to consider.

Simple is better with covered call ETFs

If you were going to sell covered calls to generate additional income from your dividend portfolio, you would likely start by building a portfolio of stocks you like. And then you would start looking at selling covered calls on those stocks. You would probably find that selling covered calls worked better at different times for different stocks, which would leave you strategically selling covered calls across the portfolio. This is what Amplify CWP Enhanced Dividend Income ETF and Amplify CWP International Enhanced Dividend Income ETF both do.

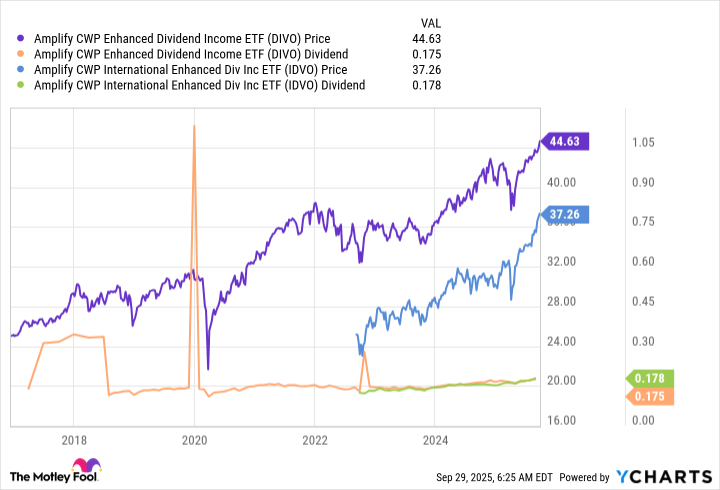

Data by YCharts.

The difference between these two covered call ETFs is in the name. One is focused on international stocks and the other is U.S.-focused. Amplify CWP Enhanced Dividend Income ETF owns around 30 stocks that are fairly well diversified by sector. And it sells covered calls on just a portion of the portfolio at any given time. That allows the owners of the ETF to generate extra income and benefit from capital appreciation, too. (Covered calls can limit the upside of a stock if the call is exercised.)

Amplify CWP International Enhanced Dividend Income ETF owns around 60 or so stocks, applying the same basic approach to foreign stocks.

In both cases, the outcome has been a fairly reliable dividend over time, accompanied by a rising share price. Amplify CWP Enhanced Dividend Income ETF has a yield of around 4.6%. Amplify CWP International Enhanced Dividend Income ETF has a trailing 12-month yield of around 5.5%. Both are actively managed ETFs and have fairly high expense ratios of 0.56% and 0.66%, respectively. But if you are looking for consistent income from a covered-call strategy, these ETFs basically do what you would do if you chose to sell covered calls yourself.

Be careful how far you reach for yield

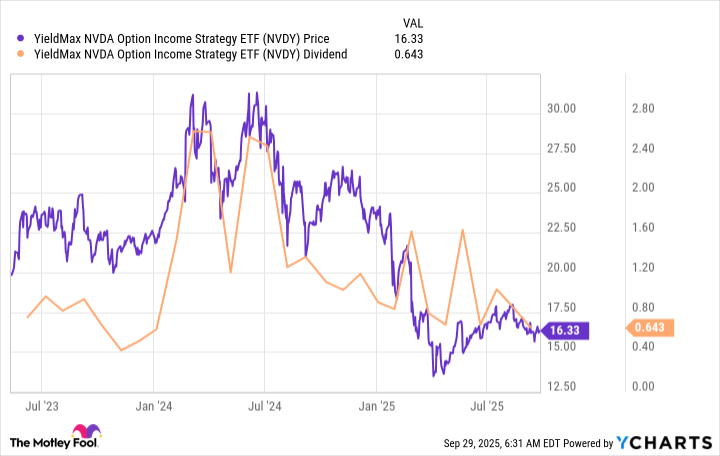

At the other extreme is YieldMax NVDA Option Income Strategy ETF. It is actually just one of an entire family of option income ETFs offered by YieldMax. YieldMax NVDA Option Income Strategy ETF’s trailing 12-month yield is 81%. If that sounds too good to be true, it likely is.

For starters, many of the YieldMax ETFs are focused on just one stock, and they use a complex options approach to generate income instead of buying the stock and then selling covered calls. That’s a lot more aggressive than what either of the Amplify ETFs does.

On top of that, option income can be highly variable from month to month for any given stock. Amplify addresses that issue by having a diversified portfolio and selling covered calls strategically. YieldMax NVDA Option Income Strategy can’t do that. The income it generates is entirely reliant on just one stock. As the chart below highlights, the income you actually collect can change dramatically each month.

Data by YCharts.

Then there’s the risk posed by return of capital. Notice in the chart above how YieldMax NVDA Option Income Strategy ETF’s price has declined over time. That’s because it is paying so much out in dividends that it is depleting its capital. There are some fairly complex tax issues involved here, but from a practical point of view, you are getting some of your original investment back with each dividend you collect. The only way to avoid that is if the underlying stock goes up dramatically. That can happen for a period of time, but Wall Street has a habit of pushing up stocks and then eventually pushing them down again. There are no free lunches, as the saying goes.

Meanwhile, the expense ratio for YieldMax NVDA Option Income Strategy ETF is a lofty 1.27%. You are paying more for a less reliable income stream and the risk of your capital declining over time.

Keep it simple and go with DIVO or IDVO

To be fair, the huge yield numbers from YieldMax Option Income ETFs are very alluring. And perhaps for some investors, they will be a good fit. But if you are looking for a long-term investment, you should probably keep it simple and focus on option income ETFs that do what you would do. Amplify CWP Enhanced Dividend Income ETF and Amplify CWP International Enhanced Dividend Income ETF don’t have the highest yields, but they do have much more sustainable investment approaches.

Reuben Gregg Brewer has positions in Amplify ETF Trust-Amplify Cwp Enhanced Dividend Income ETF. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.