Warren Buffett has built an incredible track record running Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). And he did it using simple-to-understand logic: Buy well-run companies when they look attractively priced and then hold for the long term (so you can benefit from the growth of the business over time). But even well-run companies fall out of favor, and that’s why this Buffett stock, with a lofty 4.7% dividend yield, is worth buying in July.

Two oil picks with different industry approaches

Energy stocks are currently suffering through a period of volatility thanks to geopolitical tensions. That’s not unusual at all. The energy market is known for being volatile, and so are most stocks in the energy sector. Buffett has two energy investments, Occidental Petroleum (OXY -0.27%) and Chevron (CVX 0.34%). They have materially different industry positions.

Image source: Getty Images.

Oxy, as it is more commonly known, is focused on growing its business as quickly as practicable so it can better compete with established industry giants like, well, Chevron. Chevron, an industry giant, is focused on slow growth and — here’s the key for investors — surviving through the inherent ups and downs of the energy sector. The second bit is why Chevron is so attractive as July gets underway.

There are three parts to Chevron’s story. The one that will likely be most interesting to investors is its reliable dividend. The integrated energy giant has increased its dividend year in and year out for 38 consecutive years. That’s an incredible streak given the price swings that have occurred in oil over that span. The company is, clearly, focused on rewarding investors for sticking around.

The interesting part is that this reliable dividend stock’s dividend yield gets attractive during the tough times. Right now is a tough time thanks to both industry issues and some company-specific problems. History suggests Chevron will muddle through and continue to pay its dividend. In the meantime, investors can collect a hefty 4.7% dividend yield.

What backs Chevron’s lofty yield?

A big yield that gets reliably paid is nice, but it doesn’t fully explain why Buffett has Chevron in Berkshire Hathaway’s portfolio. Which is where the next two parts of the Chevron story come in.

First, Chevron is an integrated energy giant. That means that it has exposure to the entire energy value chain, from producing oil and natural gas, to transporting the commodities, to processing them into other products. Each segment works a little differently through the energy cycle. Having exposure to all of them helps to smooth out performance over time. On top of that diversification, Chevron also has a global portfolio. So it can shift its investments to where they will have the best opportunity for success.

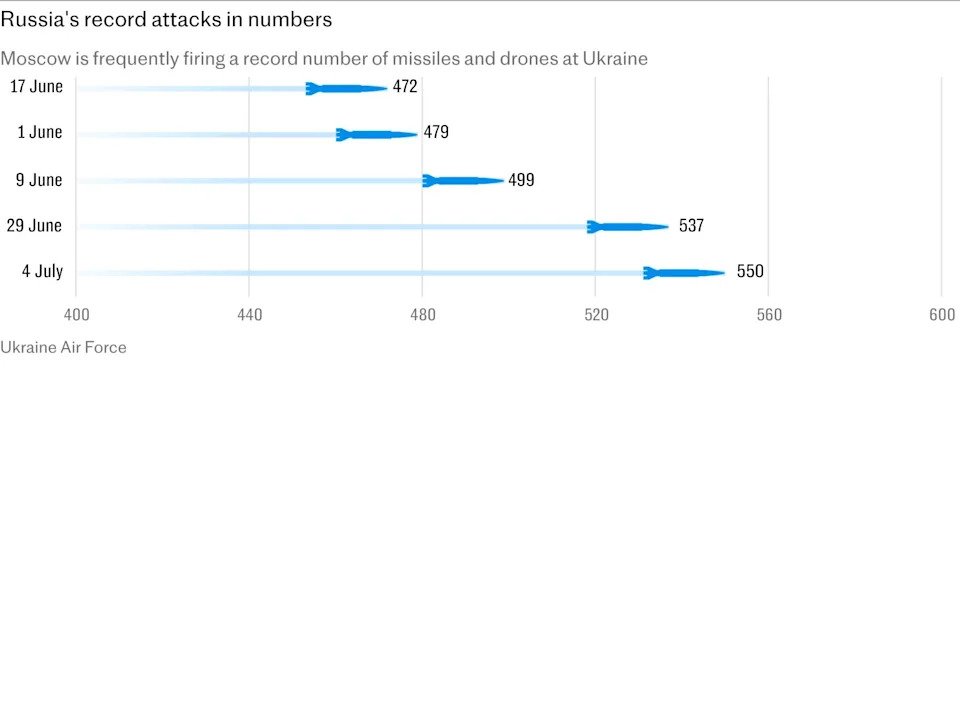

CVX Debt to Equity Ratio data by YCharts

That’s a solid start, but there’s another important factor. Chevron also has one of the strongest balance sheets in the energy patch, with a debt-to-equity ratio of just 0.2 times. That gives management the leeway to add debt during industry downturns so it can continue to support the business and dividend through hard times. When commodity prices recover, as they always have historically, it pays down its debt in preparation for the next downturn.

Buy Chevron when others are selling the stock

Chevron’s stock is down around 20% from its 2022 highs, when oil prices were much higher. Long-term dividend investors shouldn’t get too hung up on the downturn or the reasons why. Chevron is built to survive whatever comes its way. It probably makes more sense to just follow Buffett’s “simple” approach and buy this well-run company while it is attractively priced and then hold it for the long term.

Reuben Gregg Brewer has positions in TotalEnergies. The Motley Fool has positions in and recommends Berkshire Hathaway and Chevron. The Motley Fool recommends BP and Occidental Petroleum. The Motley Fool has a disclosure policy.