Investing in this ETF could prove to be lucrative for patient investors.

One of my favorite ways to invest in stocks is through exchange-traded funds (ETFs) because they simplify the investment process. You don’t need to spend hours researching companies or making the “right” investment. Instead, you can invest in an ETF and instantly get access to many companies at once.

Investing in ETFs doesn’t have to mean sacrificing gains, either. There are plenty of ETFs that have delivered market-beating returns and made investors a lot of money along the way.

One Vanguard ETF in particular has the potential to turn $500 monthly investments into over $680,000. And to add the icing on the cake, that could mean around $20,500 in annual dividend income. Talk about a win-win.

Image source: Getty Images.

An ETF filled with high-quality companies

The Vanguard ETF I’m referring to is the Vanguard High Dividend Yield ETF (VYM 0.44%). As its name suggests, it’s a dividend-focused ETF that could be a great income-producing investment. It mirrors the FTSE High Dividend Yield Index, which focuses mainly on large-cap companies with above-average dividend yields (there are a few non-large-cap companies included).

This criteria means that VYM holds many well-established companies with solid cash flow, consistent dividend histories, and longevity. Below are the ETF’s top 10 holdings:

| Company | Percentage of the ETF |

|---|---|

| Broadcom | 6.69% |

| JPMorgan Chase & Co. | 4.08% |

| ExxonMobil | 2.41% |

| Johnson & Johnson | 2.08% |

| Walmart | 2.06% |

| Home Depot | 1.97% |

| AbbVie | 1.82% |

| Procter & Gamble | 1.80% |

| Bank of America | 1.70% |

| Chevron | 1.50% |

Data source: Vanguard. Percentages as of Aug. 31.

Unlike the S&P 500 (^GSPC 0.53%) or other growth ETFs, the dividend focus means it’s not as tech-heavy as other indexes and ETFs. Whereas the tech sector is around 33% of the S&P 500, it’s only around 12% of VYM, meaning it could be a good way to hedge against down periods in the sector or overvalued tech stocks due for a correction.

A consistent above-average dividend yield

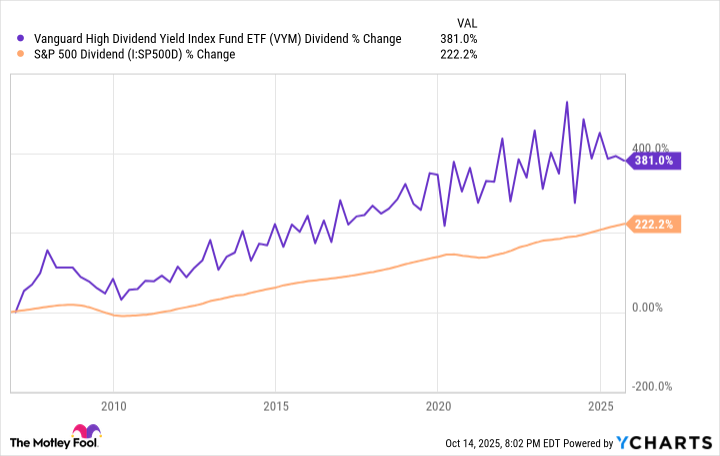

Since different companies pay dividends at different times, the amount of VYM’s quarterly dividend fluctuates. Its last four per-share payouts were $0.8417 (September 2025), $0.8617 (June 2025), $0.85 (March 2025), and $0.9642 (December 2024). That said, one thing that you can likely count on is VYM’s dividend increasing over time.

Since its inception, the payout has increased by over 380%, far more than the S&P 500 dividend payout has increased in that span.

VYM Dividend data by YCharts

An above-average dividend is nice, but an above-average dividend that consistently increases over time can be an added bonus.

How investing in VYM could be lucrative for investors

Over the past decade, VYM has averaged around 11.2% annual total returns. Past performance doesn’t guarantee future performance, but if we assume it continues to average around 11% annual returns, below is how much $500 monthly investments could grow to over time, assuming dividends get reinvested.

| Years | Investment Total |

|---|---|

| 10 | $100,300 |

| 15 | $206,400 |

| 20 | $385,200 |

| 25 | $686,400 |

| 30 | $1.19 million |

Calculations by author via Investor.gov. Totals rounded down to the nearest hundred.

Having 30 years to grow an investment over $1.19 million is ideal, but for the sake of this illustration, let’s assume you have 25 years and your investment grows to around $686,000 after accounting for VYM’s 0.06% expense ratio. VYM’s average dividend yield over the past decade is 3%. With $686,000 invested in the ETF, a 3% dividend yield would pay out $20,580 annually.

Nothing is guaranteed in the stock market, and we can’t predict stock price movements, but this shows the power of time and compound earnings in investing — especially when dividends are involved. Time and patience can quite literally pay off.

Bank of America is an advertising partner of Motley Fool Money. JPMorgan Chase is an advertising partner of Motley Fool Money. Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends AbbVie, Chevron, Home Depot, JPMorgan Chase, Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF, and Walmart. The Motley Fool recommends Broadcom and Johnson & Johnson. The Motley Fool has a disclosure policy.