ASML is a key company in the AI world.

Palantir Technologies (PLTR 3.08%) has been one of the hottest stocks in the market, rising an astounding 2,660% from the start of 2023 (not long after the AI arms race began to heat up) to now. As well as Palantir has done over that time, there’s another AI stock that I like even more. And three years from now, it could easily be worth more than Palantir by then.

ASML (ASML 0.51%) is perhaps the most important company in the world that nobody knows about. With ASML’s technology, the AI we know today wouldn’t be possible. The stock has underperformed recently, trading off around 15.5% from its all-time high. I think ASML can recover from this drop and easily be worth more than Palantir three years from now, but it likely won’t get there the way most investors think it will.

Image source: Getty Images.

Palantir’s stock price has reached unreasonable levels

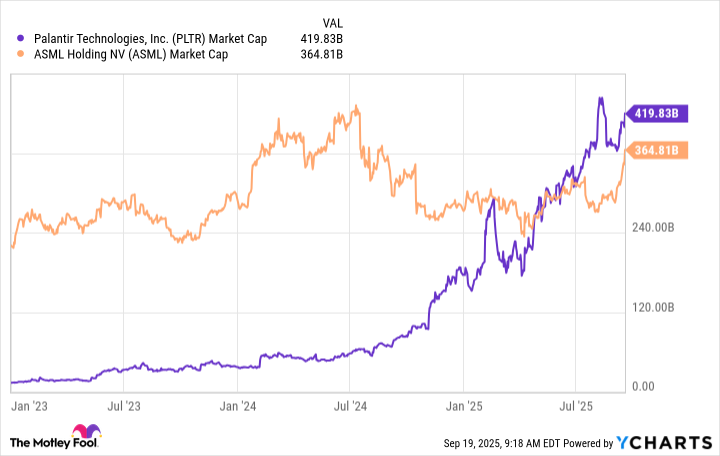

When I refer to ASML being worth more than Palantir, it may seem confusing because ASML’s stock price is nearly $900 while Palantir’s is $170. However, I’m not referring to the per-share price; I’m talking about its valuation, also known as a market cap. This is how much a company is worth when its stock price is multiplied by the total number of shares outstanding. Because a company can issue as many shares as it wants, the stock price tends to be less indicative of the true value of a company.

Palantir overtook ASML’s market cap earlier this year, and it is now valued at nearly $420 billion versus ASML’s almost $365 billion.

Data by YCharts.

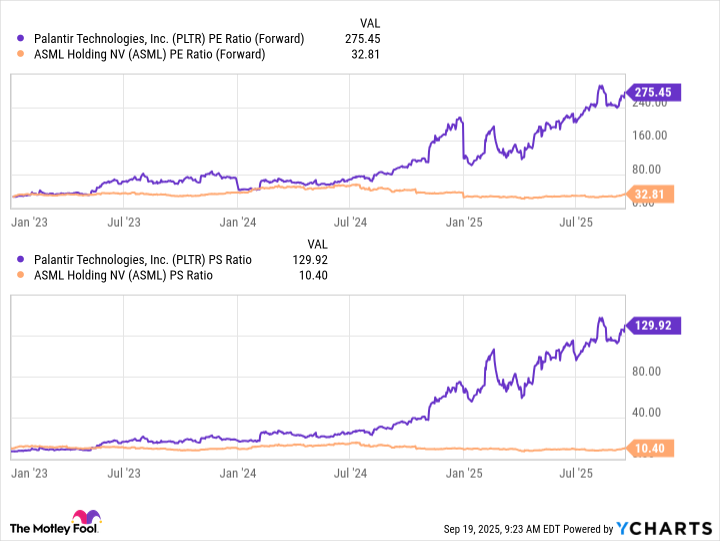

However, I’d argue that Palantir’s $420 billion market cap isn’t as solid as some might think. To reach that level, Palantir’s stock valuation had to rise to unbelievable levels. It trades for 130 times sales and 275 times forward earnings.

Data by YCharts.

Those are levels that few companies reach, and are partially based on irrational investor enthusiasm for Palantir’s growth rates. In those rare instances where a stock achieved these valuation levels, it was usually correlated with a company doubling or tripling its revenue year over year each quarter. In Q2, Palantir’s revenue rose 48% year over year. While that’s impressive, it’s a long way away from justifying these valuations or its stock price.

As a result, I think Palantir’s stock is ripe for a significant pullback over the next three years, which would result in ASML again being considered more valuable.

ASML is one of the most important companies in the AI realm

ASML makes extreme ultraviolet (EUV) lithography machines. Semiconductor companies use these machines to help build the very complex computer chips they have designed. Without ASML’s machines, the powerful chips that execute the calculations needed to train and run AI models (such as those used by Palantir) wouldn’t be possible. As a result, ASML is one of the world’s most important companies, especially because nobody else has this patented technology. ASML holds a technological monopoly in this space. ASML has a massive head start in this area and because it would take years for another company to get anywhere close to what ASML is right now, there is essentially no competition.

ASML also expects strong growth in the years ahead because of rising chip demand. Management believes there is a 44 billion euro to 60 billion euro market potential by 2030, which indicates solid growth from today’s 32.2 billion trailing-12-month total. ASML’s management is notoriously conservative with its estimates, and I believe its revenue will come in on the higher end of this range.

With ASML already trading for a reasonable valuation considering its monopoly and growth trends, I think ASML has a chance to be a solid performer over the next few years. With Palantir’s stock ripe for a pullback due to its unreasonable valuation, I think there’s a high likelihood that ASML will be a larger company than Palantir is three years from now.

Keithen Drury has positions in ASML. The Motley Fool has positions in and recommends ASML and Palantir Technologies. The Motley Fool has a disclosure policy.