AppLovin’s advertising business is growing rapidly due to its proprietary artificial intelligence (AI) engine.

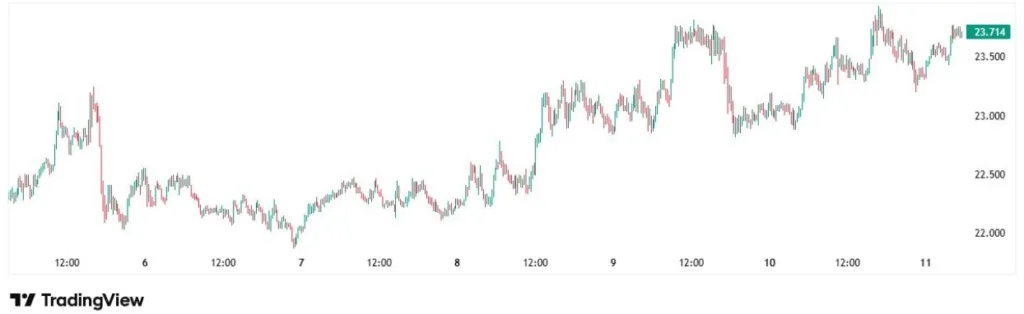

AppLovin (APP -1.92%) will be added to the S&P 500 (^GSPC -0.32%) before the U.S. stock market opens on Monday, Sept. 22. AppLovin stock has advanced 4,560% since January 2023, doubling Palantir‘s 2,280% return during the same period.

Better yet, Wall Street expects AppLovin shareholders to turn a profit in the next year. Among 29 analysts, the average 12-month target price is $514 per share, which implies 5% upside from its current share price of $490, and that figure may increase with inclusion in the S&P 500 on the horizon.

Here’s what investors should know.

Image source: Getty Images.

Historically, stock prices tend to increase following their addition to the S&P 500

The S&P 500 measures the performance of 500 large U.S. companies. The index is widely considered the best gauge for the entire U.S. stock market because it covers approximately 80% of domestic equities by market value.

To be included, a company must be worth at least $22.7 billion and have reported a generally accepted accounting principles (GAAP) profit in the last quarter. The stock must also be sufficiently liquid, and at least 50% of shares must be available for public trading. Even after those criteria are met, inclusion is still at the discretion of the selection committee.

In the last decade, 176 companies were added to the S&P 500, which means about 35% of the index was replaced. Of that group, 159 companies have been members of the S&P 500 for at least one year, and those stocks returned an average of 13.9% during the 12 months following their inclusion in the index.

There are two major reasons for that pattern. First, index funds that track the S&P 500 must buy newly added stocks to ensure their composition matches the benchmark. Second, investor sentiment tends to become more bullish once a company is added to the S&P 500 due to the rigorous inclusion criteria and increased visibility that comes with being a member of the most widely followed stock index on the planet.

Whatever the reason, history says AppLovin stock will advance about 14% in the 12-month period after its addition to the S&P 500 on Sept. 22. However, that alone is a poor reason to buy the stock. Prospective investors need to understand the company.

AppLovin is an adtech company that’s growing like wildfire

AppLovin develops adtech software that has traditionally helped video game developers market and monetize their products with mobile campaigns. However, the company is currently testing a new adtech solution for e-commerce brands, which serves ads across websites and expands its addressable market more than tenfold.

AppLovin has a key competitive advantage in Axon, a proprietary recommendation engine powered by artificial intelligence (AI). It matches advertiser demand with publisher supply using predictive algorithms to evaluate the likelihood that impressions will produce the desired results. In a recent note to clients, Morgan Stanley analysts called Axon a “best–in-class machine learning ad engine.”

AppLovin reported strong financial results in the second quarter. Revenue increased 77% to $1.2 billion, and GAAP net income increased 168% to $2.39 per diluted share. Investors have good reason to think that momentum will continue. AppLovin plans to launch a self-service advertising platform on a referral basis in October, followed by a global launch next year.

The company has traditionally offered managed advertising services, which entails end-to-end campaign management for brands that want to outsource the work. Introducing a self-service solution that includes e-commerce advertising tools should bring more brands to AppLovin. Indeed, CEO Adam Foroughi says the self-service solution will “serve as the foundation for our next decade of growth.”

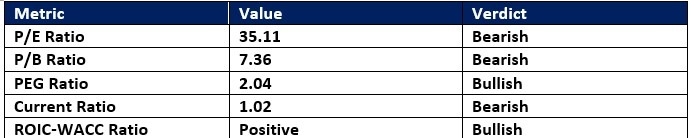

Going forward, Wall Street estimates AppLovin’s earnings will grow at 54% annually through 2026. That makes the current valuation of 70 times earnings look reasonable, especially when the company beat the consensus earnings estimate by an average of 23% during the last six quarters.

The big picture

Digital advertising is a very competitive industry that pits AppLovin against much larger companies like Alphabet‘s Google, Meta Platforms, and Amazon. However, AppLovin’s growth exploded after the 2023 launch of Axon 2.0, the latest version of its AI-powered recommendation engine, and its e-commerce and self-service solutions could be the next major catalysts. Investors comfortable with volatility should consider buying a small position.

Trevor Jennewine has positions in Amazon and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Amazon, AppLovin, Meta Platforms, and Palantir Technologies. The Motley Fool has a disclosure policy.